Two key changes in Budget 2026

Reduction of Exit tax

One of the most welcome changes is the reduction of Exit Tax from 41% to 38%, marking an initial step in making investing more attractive for individual investors. This change lowers the tax payable on investment gains for those invested in funds promoted by life companies and exchange-traded funds (ETFs).

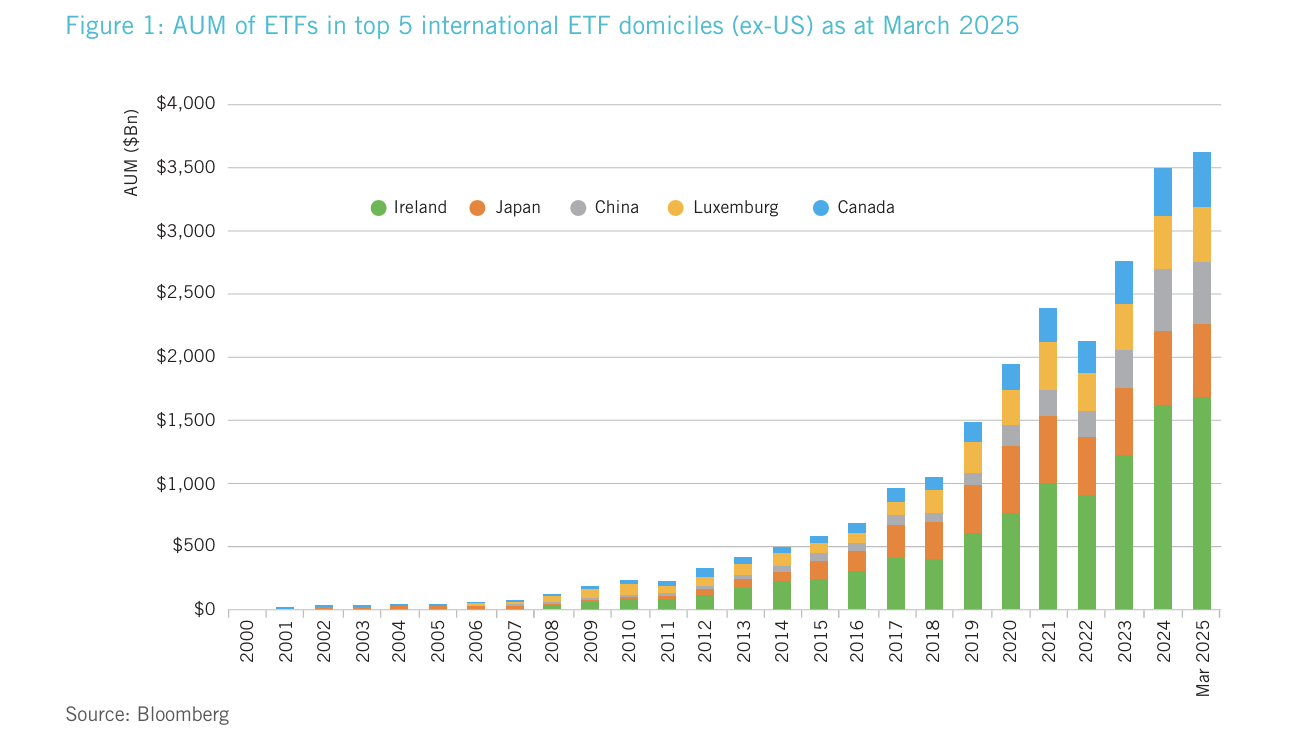

Ireland is a major centre for the administration of ETFs, with over thirty thousand jobs dependent on the fund administration sector. The Sunday Business Post recently reported that Irish-domiciled ETFs account for assets exceeding €1.35 trillion, representing 74% of all such assets in Europe. The irony for Irish investors is that the government has not encouraged personal investing in ETFs , even though we are a world centre for the administration of these funds.

What next?

The government have committed to publishing a comprehensive roadmap early next year to simplify and modernise the tax system around investing for individual investors. A positive outcome would see the following happen:

- A phased alignment of Exit Tax from 41% toward 33% - This process has started in Budget 2026, but it would be helpful to see the government commit to lowering the tax rate to 33% in line with the current capital gains tax (CGT) rate. This would mean there is no disincentive to invest in ETFs. In fact, you could argue that ETFs that accumulate dividends (don’t pay them out each year) would be more tax efficient for personal investors than individual shares.

- Abolish the eight-year deemed disposal rule, which taxes unrealised gains every eight years. This change would lead to uninterrupted compounding, which is a fundamental aspect of investing. The Government had previously signalled that it would consider abolishing this rule, so I remain hopeful we’ll see a change to it soon.

Revised Entrepreneur Relief

This was the standout positive from Budget 2026. The lifetime capital gains limit under revised entrepreneur relief has increased from €1m to €1.5m. The purpose of this relief is to reduce the capital gains tax (CGT) rate on the sale of certain business assets held by qualifying individuals. The word ‘qualifying’ is important. Entrepreneur relief can be complicated, so it's essential that you seek tax advice.

If you qualify, the CGT rate on the first €1.5 million of gains from the disposal of qualifying business assets is 10%, instead of the standard 33% CGT rate. If a business were sold at a gain of €1.5 million, under current rules*, you would pay CGT of €265,000. Once the new rules in Budget 2026 are adopted, the CGT liability in this scenario should be €150,000**, which may result in a potential CGT saving of up to €115,000.

For many people, selling or closing down their business is the culmination of a lifetime of work. Looking after existing employees, finding a buyer, and planning your future can be stressful. Good tax planning around revised entrepreneur relief can help smooth the transition, but it's important to seek advice early.

*€1M at 10%, balance of €500k at 33%- €100,000 + €165,000 = €265,000

** €1m at 10% = €100,000

+353 (0)87 344 5882

+353 (0)87 344 5882 info@saolcapital.ie

info@saolcapital.ie Saol Capital, City Quarter, Lapps Quay, Cork T12 Y3ET

Saol Capital, City Quarter, Lapps Quay, Cork T12 Y3ET